Our Expertise

Welcome to Lombard Analytics. We combine market sentiment and investor consensus data to continuously assess hundreds of stocks and identify the most promising opportunities across the U.S. and European markets.

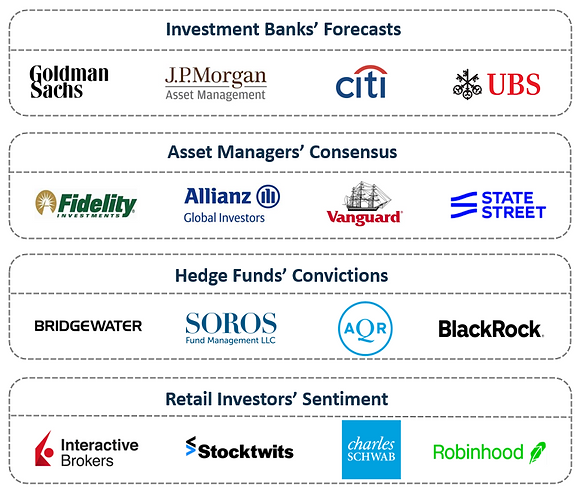

Our expertise centers on the interpretation of market sentiment—a reflection of the expectations and perspectives held by major market players such as banks, hedge funds, asset managers and other institutional analysts and investors.

This monitoring allows us ti understand what those communities think about each stock, sector, or market.

Those consensus indicators rely on three primary categories of data:

-

Forecasts & opinions published by institutional analysts and Investors

-

Institutional positionning, meaning the actual capital Allocation choices

-

Expert and retail investors Sentiment

Here is a visual synthesis with some examples:

1. Institutional Research & Outlook

This indicator reflects the expectations of the financial analyst community regarding 12-month returns for each stock and sector in our coverage.

We construct it by aggregating published forecasts and opinions from analysts and industry experts to calculate an average 12-month price target. We then interpret this data in two ways:

-

Absolute value: the overall level of optimism or pessimism

-

Trends and changes: how sentiment shifts over time

2. Institutional Portfolio Exposure

While forecasts are based on published opinions and forecast, this second indicator seeks to measure actual investment decisions made by institutional investors—such as banks, mutual funds, and hedge funds.

It reveals where the so-called “smart money” is flowing by analyzing buying and selling patterns of those institutionial investors.

Understanding these shifts helps us interpret where major investors are placing their bets for the next 12 months.

3. Retail Investor Sentiment

Whereas the first two previous indicators are built on the opinions and forecasts of market professionals, this third component is derived from the activity and presence of retail investors.

Although individual investors do not wield the same level of influence as large institutions, tracking their behavior and sentiment offers valuable insight. It allows us to either validate or challenge the directions taken by professionals, highlighting points of alignment (or divergence) between institutional views and retail dynamics.

By integrating this perspective, we gain a more balanced and comprehensive understanding of market consensus, capturing not only the voice of influent institutionals, but also the perspective of the broader investing community.

A couple of words about our editors:

Alexis Davidovic is our editorial chief. He has been an analyst and consultant in the banking sector for over 15 years, with a focus on risk management and data governance in large banking institutions. He holds a Master’s degree in Business Management and an advanced Master’s degree in Financial Risk Management.

Sarah T. Nguyen is an analyst and advisor, in charge of professional client relations. She specializes in high net worth individuals and family offices. Earlier in her career, she spent over 15 years in leadership positions at Citigroup, most recently as head of an international equities desk. Among several academic achievements, she earned an MBA from NYU Stern and is a CFA charterholder.

Why do investors trust us?

-

We are fully independent. We do not accept money from advertisers, nor are we affiliated with any financial institution or listed company. Our success depends solely on the quality of our research and the trust of our clients.

-

We make our recommendations crystal clear. For every stock, we provide an exact entry date and a set price target, ensuring our readers know exactly when to enter and exit positions.

-

Unlike many players in the field, we do follow up on every recommendation we publish. For each Top-Ranked stock, we openly share whether it reached its price target or ended in a loss, ensuring complete transparency.

-

We promote geographical diversification, giving equal focus to European and U.S. markets. We actually started as the French-speaking publication “L’Investisseur Actif”, and have gradually evolved to an English-first platform as our readership became increasingly international.

-

We achieve results that speak for themselves. Our sentiment-focused methodology delivers tangible value, with the actual returns of our top-ranked stocks detailed on our Track Record page, updated monthly.

-

Our approach, grounded entirely in sentiment and consensus analysis, is as pertinent as distinctive, and allows for robust performance and proactive risk management. You can learn more about it on our methodology page.